Who Me, an Inside Trader? Four Ways to be Guilty of Illegal Stock Trading

Some argue that insider trading has its positives, but in most of the developed world, it is severely frowned upon and is punishable by regulators

By David Wenger

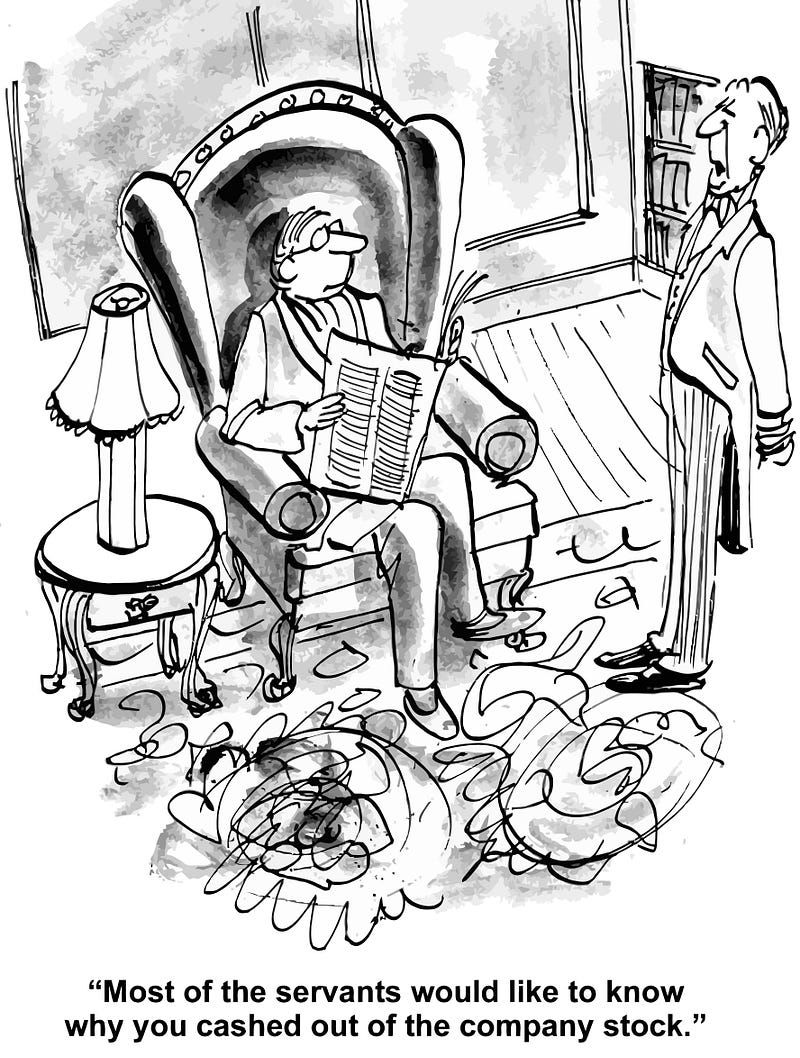

In March 2018, the U.S. Securities and Exchange Commission (SEC) charged a former Equifax executive with insider trading. When the accused heard about the major data breach at Equifax, he allegedly dumped his shares before the information became public knowledge, avoiding $117,000 in losses. The SEC brought a civil action and the U.S. Department of Justice filed parallel criminal charges.

Many insider trading cases fit this pattern: a company official with lots of his or her net worth tied up in company stock is desperate to sell stock after hearing bad news about the company and before the information gets out and the company’s stock price plummets. But there are other paths to run afoul of insider trading laws, some not so obvious.

Here in the U.S. there are basically four ways to fall into insider trading.

Consider this scenario: Giant Marbles Co. is negotiating to purchase Fast Dice Company. Giant wants to keep its acquisition plans secret, in part to keep other bidders from elevating the price it has to pay. When insider trading precedes announcement of such a purchase, buyers such as Giant typically end up paying more to complete the acquisition.

Giant, and the courts, are worried about four types of insiders who might take advantage of this information to profit at Giant’s expense:

- Company insiders: Jerry is Giant’s internal auditor. If Jerry learns of the potential purchase, he has a fiduciary responsibility to his employer to keep this substantive information secret, and to avoid making trades on Giant’s stock based on his knowledge.

- Misappropriators: Phyllis works in Jerry’s office at Giant, and she overhears some discussion about the purchase. She thinks she can make some money by purchasing Fast Dice stock now before the purchase is announced. Even though she doesn’t owe a fiduciary responsibility to Fast Dice, she would be guilty of stealing information from Giant and converting it to her own use.

- Tippees: Norm is Jerry’s fitness coach and friend. While working his biceps at the gym, Jerry mentions the upcoming deal and tells Norm that he might pick up some easy money by purchasing before the public announcement. If Norm trades in either Giant or Fast Dice stock, he is going to be liable as a tippee (and Jerry will be liable for Norm’s profits as a tipper). The law does not want Jerry to be able to trade through friends or relatives to do indirectly that which he is forbidden to do directly.

- Temporary insiders: Renee is an HR consultant hired by Giant to write a strategic plan for transitioning Fast Dice employees after the purchase. Even though she had no preexisting fiduciary responsibility to Giant or its shareholders, because she received the information from Giant for a corporate purpose (to write the plan) in a situation where Giant reasonably expected her to keep the information confidential, Renee temporarily inherits the same duty of loyalty as company insiders.

Professor Robert Prentice at Texas McCombs, writing in “Permanently Reviving the Temporary Insider” (Journal of Corporation Law), explains that restricting trading by temporary insiders protects both the integrity of the securities markets and the corporate owners of confidential information.

“Insider trading raises the cost of capital, reduces liquidity and inhibits economic development,” Prentice says. “For all of those reasons it is important to protect both the markets and the corporate owners of confidential information from the abuses of insiders of all kinds.”

We can only hope that Jerry, Phyllis, Norm, and Renee are listening.

Robert Prentice is chair of the Department of Business, Government and Society at the McCombs School of Business at The University of Texas at Austin. He is the founder of Ethics Unwrapped, a free ethics education programs used by more than 1,000 colleges and universities in 170 countries.

About this Post

Share: