Taxes

Tax Giveaways Create More Jobs When Someone’s Watching

States that subject business subsidies to internal disclosure see more employment and spend less per job

To End Multinational Tax Dodging, Global Coordination Is Key

When a country cracks down on corporate taxes, domestic companies pay more, but multinationals pay less Based on the research of…

Tax Breaks for Innovation Pay Off

Capital investments grow in countries offering lower rates for new ideas Based on the research of Lisa De Simone As policymakers…

Investors Miss Out When Tax Deals Are Concealed

Companies that get non-income tax breaks from state and local governments have higher sales and stock returns Based on the research…

One-Time Tax Items Aren’t Earnings Misconduct

Nonrecurring income taxes reflect mostly economic causes, not management manipulation Based on the research of Lillian Mills When investors try to…

Audits Can Bring Bad News or Benefits to Small Businesses

IRS review might spell the end of a small company — or teach it to be more efficient — according to a new study…

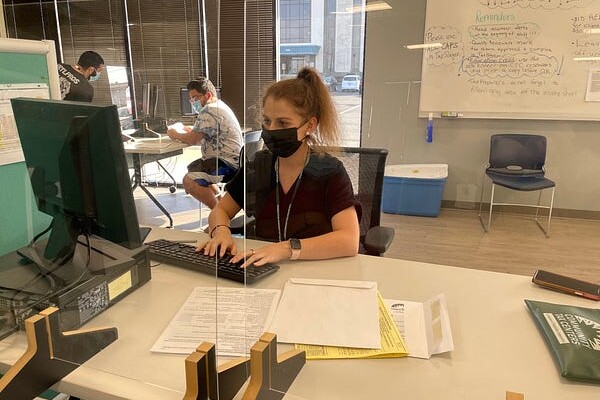

Scoring Tax Season Wins

McCombs students volunteer to help low-income families file taxes and reclaim millions for Austin economy This is the time of year…

Think Taxes When Shopping Mutual Funds

With the right strategy, mutual fund investors can enjoy both low taxes and high returns Based on the research of…

The Big Shift: More Corporate Cash Flows Into the U.S. Than Out

Despite popular belief, all U.S. firms haven’t been sending most of their earnings abroad to dodge taxes, finds a study…

Trump’s New Tax Plan Seeks to Avoid Hidden Costs of Amnesty

Research shows that one-time tax amnesties encourage more tax avoidance in the future. Will the new U.S. tax law change…