A $1 Million Boost to UT’s Venture Culture

San Antonio entrepreneur and investor Billy Freed and family donate to support students’ business efforts at Texas McCombs William “Billy”…

Experts Identify 5 Ways to Address Texas’ Housing Affordability Crisis

Texas ranks 49th in the nation on state spending for housing Driven by inflation, high demand, rising property taxes, and…

Texas McCombs at SXSW 2023

Members of our business school community were speakers, mentors, judges, and moderators at this year’s edition of the megafestival South…

Deadline Approaching to Apply for New Online Version of Nation’s Top Business Analytics Master’s Program

No. 1-ranked McCombs MSBA program now welcomes part-time students to hone business strategy around AI and big data. Application deadlines are…

How AI Can Reveal Corporate Tax Avoidance

By applying natural language processing to annual reports, researchers found clues to corporate tax avoidance strategies. Based on the research…

Acquisitions Can Nix Existing Partnerships

When one company buys another, alliances sometimes become collateral damage Based on the research of Ram Ranganathan Business alliances are…

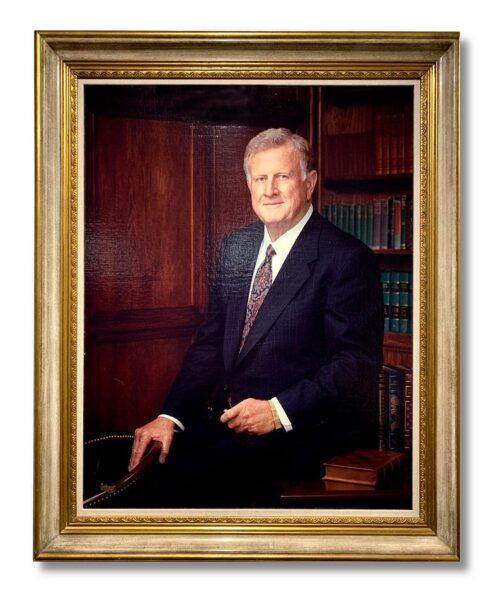

The McCombs Gift

An oral history of the largest gift in UT history: who dreamed big, how Red came on board, and how…

In His Own Words

Red McCombs was always delighted to share his larger-than-life lessons learned from decades in business When Red McCombs spoke, people…

Big Dreams and Red-Hot Connections

How 25 years of entrepreneurial energy changed the trajectory and brand of business at McCombs Fireworks light the sky over…

Class of 2022

McCombs welcomes eight new research faculty members Eight research faculty members joined Texas McCombs during fall 2022, with interests that…