Owning a Business, the ETA Way

Texas McCombs is embracing the fast-rising trend of ‘entrepreneurship through acquisition’

By Omar L. Gallaga

After Edgar Galindo, MBA ’20, finished school at Texas McCombs, he thought he’d go into consulting. That worked out; soon, he was a strategy and operations consultant at Deloitte. But after two years at the firm, the long hours wore on him, and he started thinking about what might come next.

After Edgar Galindo, MBA ’20, finished school at Texas McCombs, he thought he’d go into consulting. That worked out; soon, he was a strategy and operations consultant at Deloitte. But after two years at the firm, the long hours wore on him, and he started thinking about what might come next.

“My wife and I wanted to start a family, and for me, a sense of ownership and ability to make more decisions was important,” Galindo says. He did a short stint at Google after Deloitte but was let go in a round of layoffs.

Soon after, a friend clued him in to a growing phenomenon that has been drawing more attention in recent years: entrepreneurship through acquisition (ETA). It would change his life.

The concept: A new leader takes over a business either through self-funding or through a so-called search fund that helps ease the transition, offers guidance, and brokers the deal, typically in exchange for an equity stake. While the idea of taking over someone else’s business has been around as long as businesses have existed, the infrastructure and community around ETA funding — and some current demographic trends — have made it an attractive alternative to building a startup from scratch for some.

“He explained to me the whole ‘silver tsunami’ idea of all these baby boomers retiring. They don’t have anyone to take over their HVAC or plumbing or, in my case, landscaping business,” Galindo says.

After partnering with his friend and considering about 100 businesses as potential acquisition targets, Galindo ended up as the managing partner of Structure Landscapes, a residential lawn service with 11 full-time employees as well as contractors. Galindo closed the deal in late 2023, taking a 25% ownership of the company with his partner, who owns 75%, with the goal of acquiring and adding other landscaping businesses across central Texas to Structure.

Educating ETA

McCombs MBA students such as Galindo, and many other business leaders, have been part of a flood of interest in the ETA concept that grew during the COVID-19 pandemic, when many began seeking a new career direction. Since then, ETA communities have grown around discussions on platforms such as Instagram and TikTok.

About three years ago, McCombs began developing plans for coursework that could help students interested in the concept of ETAs learn its fundamentals and get practical experience.

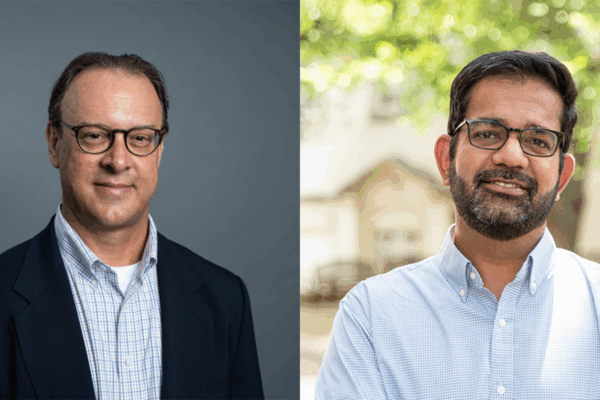

The class, the Entrepreneurship Through Acquisition and Search Fund Practicum, is now a reality, taught by Mellie Price, executive director of the newly renamed Brumley Institute for Graduate Entrepreneurship, and Jacob Hall, managing partner at investment firm Kando Capital.

Price says that the class is part of expanding the definition of entrepreneurship and recognizing that it can encompass many sizes of companies and approaches to building a business. “Any idea and any opportunity is viable in entrepreneurship,” Price says. “A large percentage of our students come from families that have family-owned businesses, and historically we’ve not done a lot other than traditional business education to teach them.

“Maybe you don’t have the idea to start the company, but you have the operating skills,” she says. It can also appeal beyond MBA graduates to veterans, students with military backgrounds, and midcareer people with operating skills who want to lead.

“It’s probably single-handedly the largest growth sector of entrepreneurship,” Price says.

Hall says that although ETA is an established concept, the ecosystem around search funds has evolved during the past few decades. Search funds can take many forms, but many of them are set up and owned by an entrepreneur to find companies for sale, help fund the sale, and get guidance through the acquisition process, which can be very complex, depending on the target company. Some entrepreneurs choose to raise their own capital for a self-funded search, but they may still need advice navigating the sale or transitioning a company and its employees to new leadership. Investors involved in a search fund, especially those who end up with an equity stake, sometimes stay involved in advising new leaders and helping make strategic decisions during the first few years after an ETA sale.

During the past few years, interest in ETA has increased dramatically for two reasons: The baby boomer generation is the largest segment of business owners in the country, and its members are retiring. Many don’t have children who are interested in taking over the business.

“There’s kind of a limited pool of people who might want to buy or acquire them,” Hall says. “So, these businesses need to transition or they go out of business. So, there is a timely opportunity that’s based on demographics.”

The pandemic also played a part in fueling the ETA movement: Lockdown and a paused economy spurred many people, especially millennials, to reconsider their careers, Hall says. Those two factors and an explosion of discussion on social media created a gold rush and a new problem. “It’s made it much harder to buy a business now than five years ago because there are far more people that are out there searching to buy businesses,” he says.

In addition to the class, which will include guest speakers and hands-on acquisition training, there’s an MBA student club for ETA at McCombs, and a student-led symposium on the topic is scheduled for Feb. 13, 2026, in Rowling Hall.

Choosing your path

Many McCombs graduates have found their passion through ETA. Larry Chapple, BBA ’10, performed transaction services at KPMG and later worked at a startup called Teamshares, which facilitates ETA deals and makes it a point to offer equity shares in the companies that are acquired.

Part of Chapple’s role was creating a pipeline of people to hire into executive leadership positions for those acquired companies. He says that Teamshares was often looking for skilled people with good critical-thinking skills, not necessarily those with much experience in the company’s respective field. “I always tell people leadership is not a position, right? When it comes to the president role, it doesn’t matter the background. If you have the inclination and the drive, who are we to say you can’t be great at running a company?”

James Jackson, BBA ’14, has seen the ETA process from both sides. His family owns an amusement park and he helped prepare the business for an upcoming sale. Jackson has learned what it’s like for buyers as a co-founder of Highland Legacy Capital, a search fund company, with his longtime friend Felipe Rojas.

The ETA community has given him a strong foundation, Jackson says. “The community of searchers, investors, search fund CEOs is incredibly generous with their time. There’s an understanding that it takes a lot of grit, hard work and genuine seller empathy to get one of these deals over the line.”

Since getting his own deal over the line to acquire Structure Landscapes in late 2023, Galindo says his newly acquired landscaping company grew 15% during the first year and is on track for an additional 18% to 20% in 2025.

“But, you know, not without some blood, sweat, and tears,” he says. He still works long hours — about 60 a week — and is often out in the sun at worksites. There are no regrets, however.

“I was more than happy to trade my desk,” Galindo says.

About this Post

Share: