20 Years of Tax Prep Help

McCombs accounting students mark a milestone in preparing income tax returns in service to the community

By Ben Wright

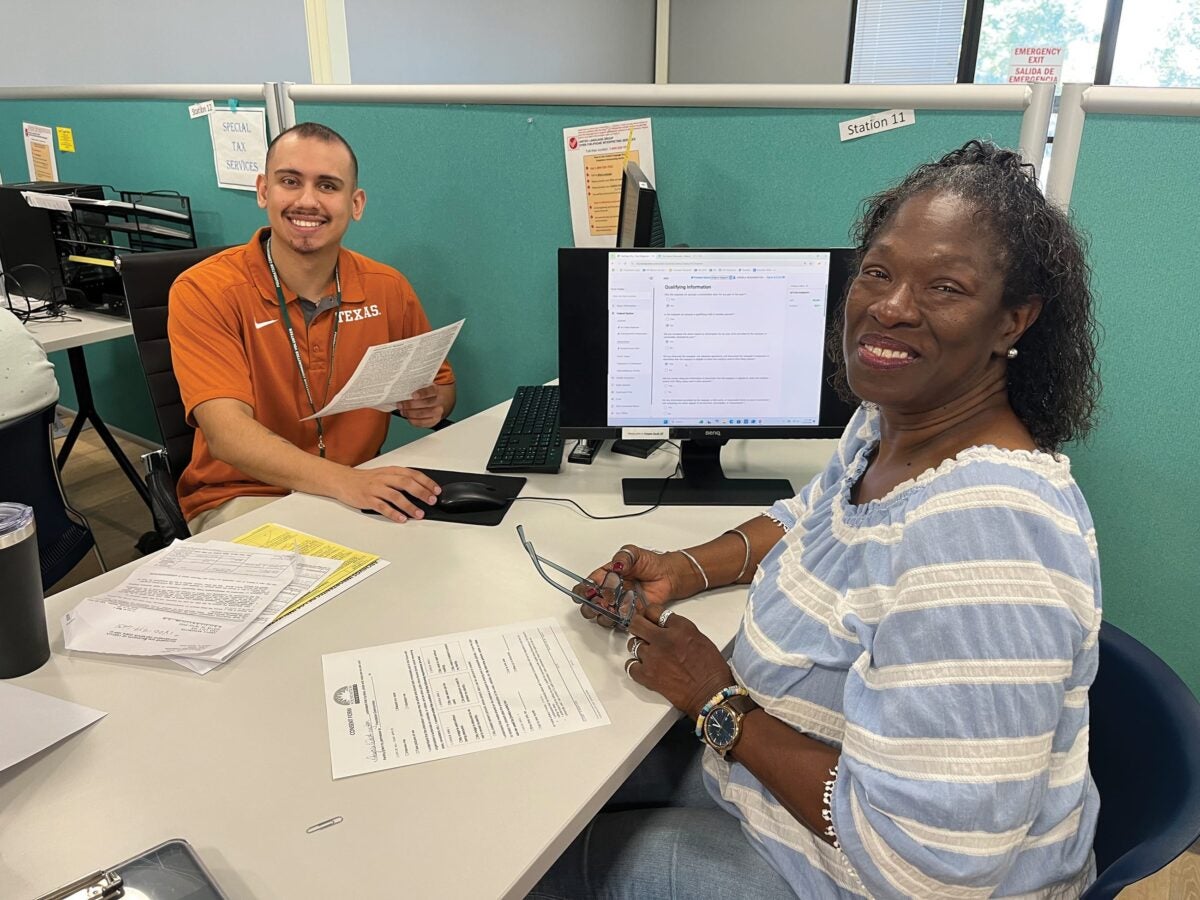

“This is something that I’ve been praying for.” That’s what a client tearfully said to Matthew Amaya, an accounting major at Texas McCombs, when he helped prepare her income taxes and gave her the good news: She’d be getting nearly $8,000 back from the IRS.

“That moment was worth the entire program,” says Amaya, a sophomore and one of over 100 McCombs students in a tax practicum class that volunteers each year with Austin-based Foundation Communities. The nonprofit provides affordable housing and support services to residents in Central and North Texas.

The practicum, which trains students to be tax preparers in the IRS’s Volunteer Income Tax Assistance program, celebrates the 20th anniversary of this unique partnership this year. During the past two decades, nearly 3,000 McCombs students have participated, saving taxpayers over a quarter of a billion dollars. This year, Foundation Communities expects to help 16,000 people get refunds totaling $25 million.

“We could not do what we do at the scale that we do it without this partnership,” says Jackie Cuéllar, director of corporate and volunteer engagement. “It’s probably the largest university partnership like this in the country. We’re the gold star standard with these efforts.”

Preparing tax returns is stressful and confusing for many people, but those pressures mount for low-income earners, especially ones who lack financial literacy. This is where McCombs students step in. The practicum empowers students to build their accounting skills in service to their community, pulling millions back into the local economy and making a big difference for vulnerable families and individuals.

“To see that weight lifted off a family’s shoulders — this resonates with me the most,” says Alina Swanson, MPA ’25.

McCombs students also are helping to make the tax system fairer because, each year, thousands of people with low incomes unwittingly overpay Uncle Sam.

The McCombs School and the nonprofit Foundation Communities celebrate 20 years of providing tax

preparation services. From left: Kristen Vassallo, Miller Wilbourn, and Dray Sears (all from Foundation

Communities); Megan Allen, Alice Nguyen, and Donna Blair-Johnston (from UT); Jackie Cuellar and Walter

Moreau of Foundation Communities.

“Things change year to year with taxes. We’re lucky to be financially savvy and I’ve really enjoyed passing that on to clients,” says Katelin James, an accounting major graduating this year.

McCombs lecturer and alumna Megan Allen, BBA, MPA ’06, who has deep experience with tax returns in the private sector, teaches the class along with assistant professor of instruction Donna Johnston-Blair. “The course fulfills McCombs’ internship credit, but from a broader perspective, you gain so much practical experience while also giving back to the community in a really meaningful way,” Allen says. “It’s so rewarding.”

Before students begin volunteering, Allen leads them in an IRS-certified training regimen. The training is 24 hours, supplemented with classes and guest lectures.

“The modules are so well made. You get through quicker than you expect,” says Avi Patel, BBA ’24, who volunteered last year. “And then comes the fun part.”

The “fun part” is the 60 hours students spend helping people at six tax centers in Austin and Williamson County. Clients must earn less than $60,000, or $85,000 if filing jointly. Most receive refunds, ranging from a few hundred to thousands of dollars.

Cuéllar joined Foundation Communities in 2006. In 2005 the federal Volunteer Income Tax Assistance program was turned over to community organizations. Foundation Communities “jumped on it,” Cuellar says, and so did a group of McCombs students who offered to help. Within a year, the program had tripled in size, helping prepare 7,500 returns.

With the concept proved, Foundation Communities needed partners to expand further. At the same time, then-Accounting Department Chair Ross Jennings was exploring how to increase experiential learning opportunities.

“Foundation Communities came to me and said we have a few of your students doing taxes with us, and we’d like to recognize them with a small ceremony,” recalls Jennings. “I attended the ceremony and we talked over the possibility of broadening the University’s participation. I asked (accounting professor) Steve Limberg to design the class. He did an amazing job, and we had lots of students sign up. I have such a high level of pride in the program.”

Students gain a range of skills and knowledge, from tax law to customer service. But as Jennings points out, the secret sauce is to “get students out of their comfort zone and expose them to a side of life they didn’t know.”

It is a goal shared by Foundation Communities. “My hope is that when they step away, they will take with them a sense of philanthropy. As they go to the communities where they will raise their own families, they will see those who need help and the need for community members to step up,” says Cuéllar.

Already, this year’s students say their experiences have energized them and transformed their views about earners of modest means.

Katelin James recalls an elderly woman who sought help with a joint return. But as James looked through the woman’s documents, she found a death certificate. The woman’s husband had died only a couple of weeks earlier.

“Her husband had always done the taxes,” James says. “So, you’re not just doing taxes. You’re helping someone through life’s hard moments, and you learn that people are doing the best with what they have.”

For other students, knowing a language other than English comes in handy. Patel remembers helping one client who was more comfortable speaking Gujarati, an Indian language, while Amaya says he has cherished working with Spanish-speaking clients.

“I’m a first-generation student from a low-income family,” says Amaya. “So, it feels like I’m helping family members, talking to my family, when I’m speaking Spanish with clients.”

Amaya works in a warehouse on weekends and has connected some of his colleagues to the program. Some got big refunds. And his newfound knowledge of the tax code helped him identify credits that saved his parents thousands of dollars.

Mike Nguyen, BBA ’11, says he joined the program because he needed to boost his grades with an internship credit. He found it so rewarding that he ended up volunteering 250 hours instead of the required 60.

“I really enjoyed helping people, talking to them, and hearing about their backgrounds. It helped me grow as a person,” says Nguyen. “As a UT student, you don’t often get exposed to poverty, but as I was in the program, I learned that a lot of people are struggling to meet their basic needs.”

With tax season behind them, Allen, the instructor, and Cuéllar, with Foundation Communities, are back to square one: recruiting and training students for next year. “It is a seamless partnership with McCombs that makes a lot of sense,” says Cuéllar. “The impact is phenomenal. I hope the program lasts forever.”

About this Post

Share: