Our Electric Future

In a new multidisciplinary study, researchers find the answer to our electric future is blowing in the wind — and burning natural gas. A Q&A in two parts.

By Steve Brooks

When you flick a switch, you’re not thinking about de-carbonization. You just want the lights to go on. But out on the electric grid, winds of change are blowing. A convergence of deregulation, fracking, renewables, electric vehicles, and climate concerns has transformed a once ho-hum industry into a wild ride. What will it all mean for our future electric bills, and for keeping the lights on?

It’s the kind of interdisciplinary policy question that UT Austin’s Energy Institute was created to address. Its recent study Full Cost of Electricity pulled together 23 researchers from 11 different schools and centers on campus. They include three who teach at McCombs: Jim Dyer, professor of Information, Risk and Operations Management; Carey King, lecturer in Business, Government and Society and assistant director at the Energy Institute; and Fred Beach, lecturer in Finance and assistant director for policy studies at the Energy Institute.

Big Ideas sat down with all three to find out what they learned and what lies ahead. In Part 1, they discuss how two big trends — de-carbonization and electrification — are changing electric grids across the country. They also unveil a series of maps, which show on a county-by-county basis how our power system is poised to change. The lowest cost power plants in most regions are wind, natural gas, and solar.

Why choose electricity as your first multidisciplinary topic?

Beach: Electricity is one of the most complex parts of the energy sector. The engineers will tell you the best power plant to build. The economists will tell you the best approach to use from a financial perspective. The policy people will tell you what to do based on what they perceive people want. Electricity is an area where all these disciplines really are required.

The second reason we looked at this segment is that it’s changing rapidly in the U.S. The influx of natural gas has been growing rapidly, due to the low cost, and that has had the beneficial effect of significantly reducing the CO2 emissions from generation in the U.S. compared to Europe. It’s like we’re achieving some of the same end goals the Europeans have touted, but we’re achieving them with different levers, primarily market levers.

How can market levers cut carbon emissions?

Dyer: The structure under which electric power is produced has changed in Texas and many other parts of the country, from a regulated system to a deregulated system. Opening up the production of power to the market is allowing people to go out and build a power plant and get it into the system, at the very same time that we’re having this debate about carbon and de-carbonization of power.

De-carbonization? What’s that?

Beach: It means a lower carbon intensity in our electricity sector, and it’s a trend that has been going on for almost 100 years. Once upon a time, we burned wood to generate steam, to turn turbines. Then we transitioned from wood to coal. Now we’re transitioning from coal to natural gas and nuclear and renewables.

A parallel trend is electrification, the degree to which we employ electricity for more and more devices. The one that’s starting now is electrification of transportation. In the United States, private light-duty vehicles use almost a third of our total energy. Of course, it has been 100 percent carbon-based. If even a small fraction of that moves towards electrification, that is a huge shift. So as the electricity sector gets cleaner and less carbon-intense, it starts to also clean up the transportation sector.

You call your project Full Cost of Electricity. What’s the connection between these market trends and the cost of power?

Dyer: When regulated utility companies start thinking about building a new power plant, they’ll say, ‘Now, what would be the cheapest power plant to build?’ In an unregulated environment, entrepreneurs decide whether or not they can make a profit by creating a plant — building it and selling it into the grid. That first calculation is based on some simplified assumptions about such things as the number of hours per year that the plant would be operating and the cost of natural gas.

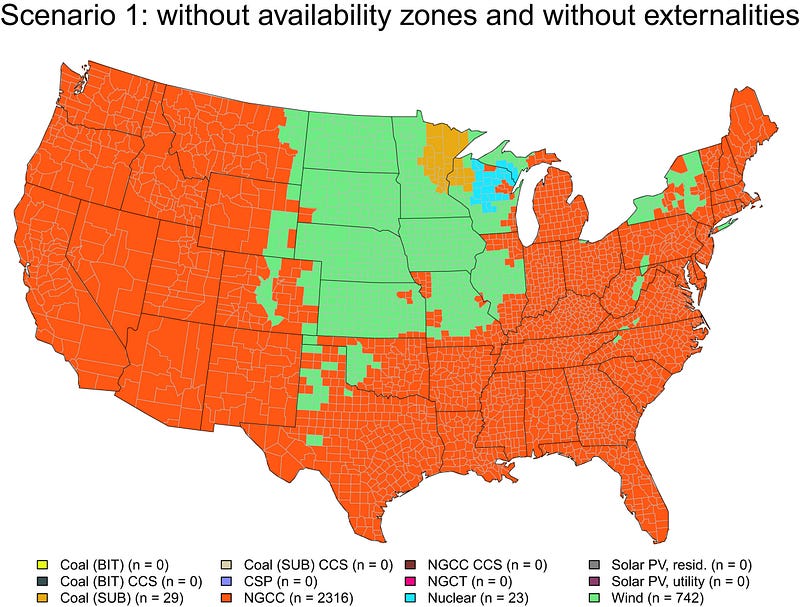

Scenario 1 shows which sources will produce the cheapest electricity, based on today’s costs. It’s striking that over 98 percent of the nation, the least-cost power sources are now natural gas and wind.

King: If you just look at what power plants are getting built right now, it’s pretty much only wind, natural gas, and solar.

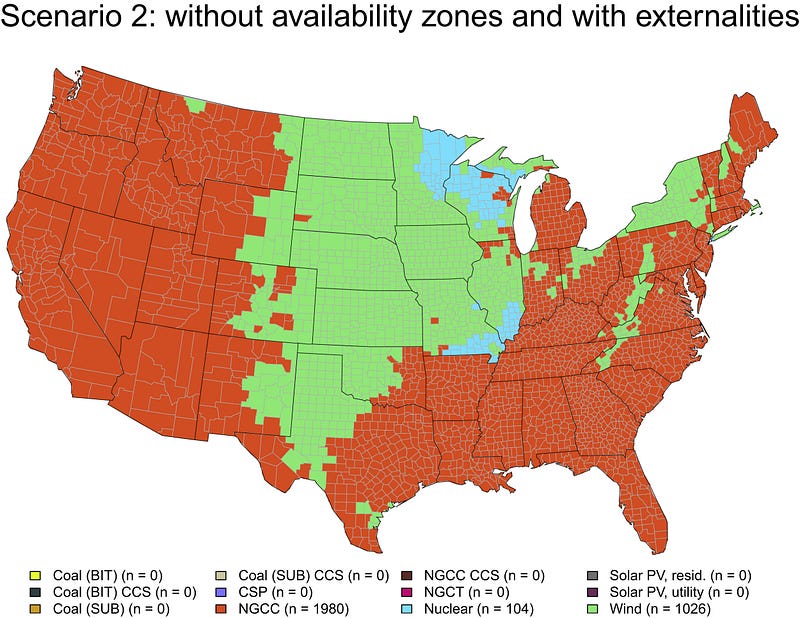

In Scenario 2, you add in “externalities.” What are those?

King: They’re costs that are not in your electric bill, costs that someone other than the electric user is paying for.

Beach: Some of the costs are embodied in other things. There are regulatory costs. There are subsidy costs that are in our tax bills, so to speak. The other thing we tried to capture are the environmental costs that we all endure but are not monetized anywhere, except in health costs to society.

It’s surprising that even though you’re adding in environmental costs, Scenario 2 doesn’t show a huge shift from Scenario 1. The major change is that wind expands from 24 percent to 33 percent of the country.

King: I wouldn’t expect the planning process to change a lot when you add environmental costs. They mostly reflect what future regulations might be about carbon. We already regulate other emissions — sulfur dioxide or nitrogen oxide — so those things are already part of the process. Historically, the largest influence has been what the price of natural gas is going to be. It affects your profitability even if you’re not a natural gas power plant owner.

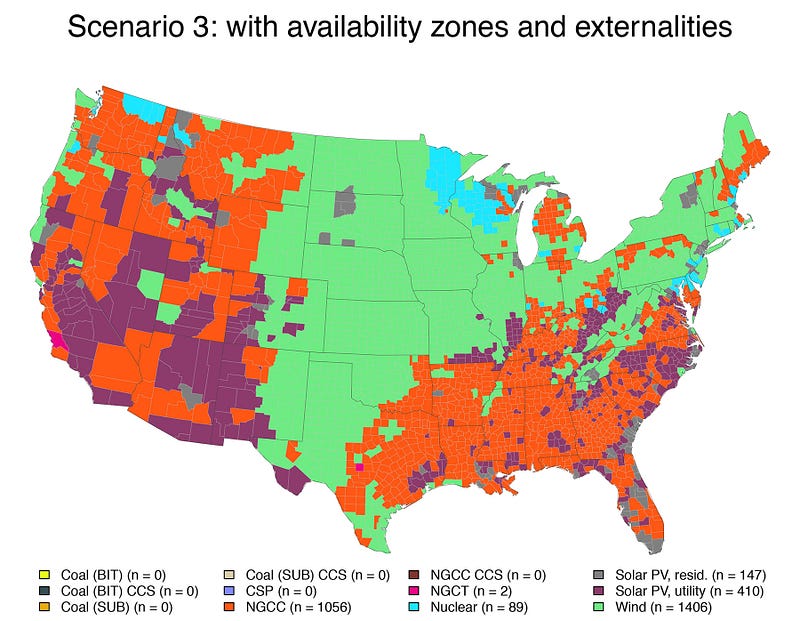

Scenario 3 differs dramatically from the first two. It factors in geographical restrictions along with costs. How do those limit sites for power plants?

King: There would be some places where you might not be very likely to install a certain type of power plant, even if it would be cost-effective. Examples would be areas with known seismic zones. You wouldn’t want to put a nuclear plant there.

What stands out about Scenario 3 is its diversity. There are bigger roles for solar and nuclear. Wind overtakes natural gas. Why are there fewer locations for natural gas-powered plants?

Beach: If you’re going to build what we call a thermal power plant, such as some kinds of natural gas power plants, you need cooling water. So it’s pretty hard to build one of those in the desert. It’s also pretty hard to build some of those in a city center.

King: Also, if it’s too far from a natural gas pipeline, then you might not put a natural gas plant there, because the cost of building the pipeline overcomes the cost advantage when considering the cost of the power plant only.

Is the message of Scenario 3 that energy policy is not one-size-fits-all?

Dyer: Exactly. It’s not all solar, it’s not all wind, and it’s not all natural gas. It’s going to be a mix, and the best alternatives depends on where you are in the United States.

Beach: We have a huge, diverse country. When people say, ‘We need an energy policy for the United States and our energy policy should be wind or solar or natural gas or whatever,’ it’s not that simple. If you live in an area where natural gas is expensive because you don’t have good pipeline infrastructure, it would hurt you to have a natural gas policy. If you live in Seattle and there’s very, very little sun, a solar policy would hurt you. What that last map really tries to drive home is, it does matter where you live.

Keep reading. The Q&A continues in Part 2.

For more information, go to the Energy Institute’s report Full Cost of Electricity.