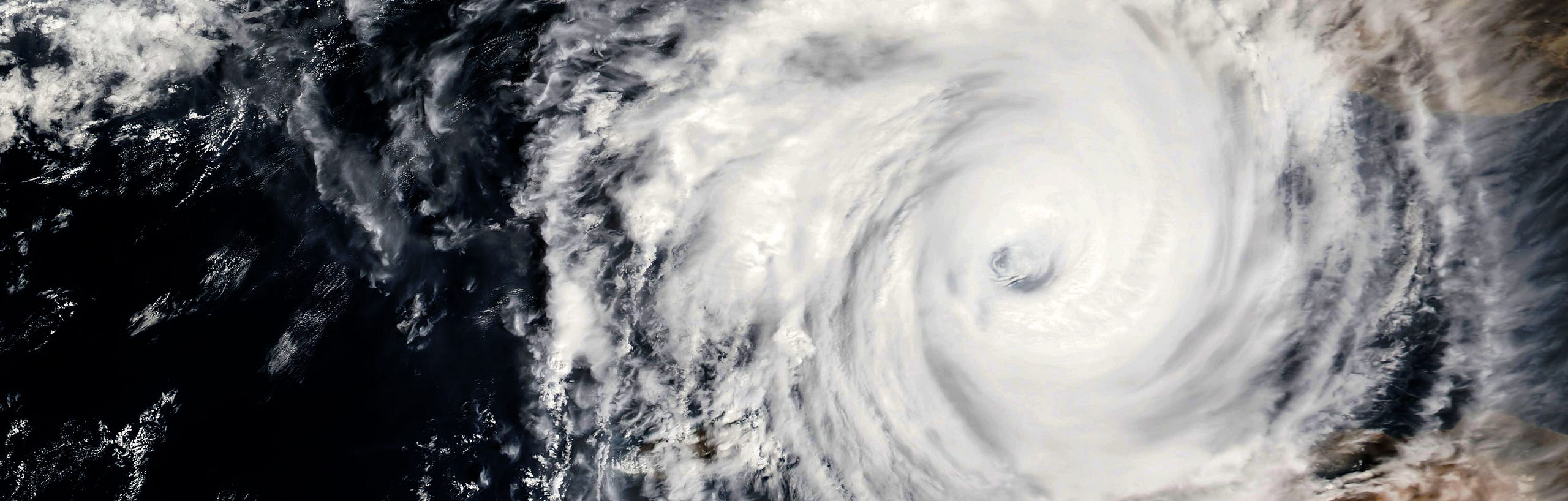

Hurricane Season Could Bring Higher Energy Prices

In addition to causing millions of dollars in property damage, hurricanes also create volatility in the prices of oil and gas.

by Rob Heidrick

In May, the National Oceanic and Atmospheric Administration predicted an “above-normal” hurricane season this year, with a 70 percent likelihood of 11 to 17 named storms, including 2 to 4 major hurricanes. The forecast seems to be holding up: Just as category 4 Hurricane Harvey pummeled its way across southeast Texas, category 5 Hurricane Irma is picking up strength and speed in the Atlantic.

In addition to causing millions of dollars in property damage, hurricanes also create volatility in the financial markets, especially with regard to energy prices. Hurricanes Katrina and Rita each prompted record spikes in the cost of gasoline and natural gas.

Ehud Ronn, a McCombs finance professor and director of the Center for Energy Finance Education and Research, studies the effects of extreme weather on the prices of oil and natural gas.

Before Harvey, the impact of hurricanes on the oil industry had been “muted” since Katrina and Rita struck in 2005, Ronn says. There are two main reasons for that: First, none of the hurricanes that hit the oil-producing areas in the Gulf of Mexico since then had reached the same intensity of those two storms.

The second explanation has to do with the shale gas boom. “The advent of hydraulic fracturing appears to have made offshore drilling for oil and gas less important to the oil industry, and so hurricanes appear to have less disruptive impact,” Ronn says.

Below, Ronn further explains the link between hurricanes and energy prices.

How do hurricanes affect oil and gas prices?

When a hurricane strikes, oil rig managers in the Gulf evacuate their platforms to assure the safety of their employees. These shutdowns disrupt the supply of oil and gas coming into the market, which in turn causes their prices to increase (in keeping with the traditional economic principle that a decline in supply leads to higher prices). This is also why fuel costs spike during geopolitical crises in the Middle East, Ronn says.

How long-lasting are the financial effects of a hurricane?

It varies, depending in part on the extent of the storm’s damage to drilling platforms. Industry officials estimate that Katrina and Rita destroyed 115 platforms and damaged another 52, as well as 535 segments of pipeline.

“If the hurricane turns out to be mild, the returning employees will have the rig up and running in short order. In that case, prices will revert within a week or even more quickly,” Ronn says.

“However, if significant damage has occurred, it will take some time to repair and bring the rigs up to full operating capacity.”

There are also other factors at play that can influence prices, making it more difficult to predict how the market will respond. A harsh winter following hurricane season, for example, can prolong the market’s volatility for several months.

“Toward the end of the hurricane season, we begin to get a sense of how severe the upcoming winter will be,” Ronn says. “The effects of this are unrelated to the hurricanes, but they will clearly impact prices.”

That’s what happened in the wake of Katrina and Rita. The price of natural gas spiked immediately after those storms landed in August and September 2005, but it continued to rise through the winter and didn’t return to its pre-hurricane level until February 2006.

“Due to the observed winter-related events, that seemingly long-lasting price impact cannot all be attributed to the two major hurricanes of ’05,” Ronn says.

Has the oil and gas industry made any improvements in preparing for and responding to hurricanes since the 2005 storms?

The destruction caused by Katrina and Rita prompted drilling companies to install new types of infrastructure that could better withstand forceful waves and wind.

They also revealed new information about weather conditions in the Gulf, prompting the American Petroleum Institute to revise its recommended practices for the industry. According to the API, the storms also led to closer collaboration between the industry and government agencies, which helped improve preparedness for subsequent natural disasters, including Hurricane Ike in 2008.

Fracking has reduced reliance on offshore drilling in recent years — but will that trend continue in the long term?

The Energy Information Administration estimates there are more than 2,200 trillion cubic feet of recoverable natural gas in the U.S. It would take about 90 years to use that much gas at the current rate. Fracking now accounts for about 40 percent of domestic gas production, but Ronn says that figure “is expected to increase dramatically over the next 30 years.”

“I do indeed expect fracking to be a long-lasting phenomenon,” Ronn says.