Autonomous Cars and the Coming Revolution

Insights about the transportation industry’s imminent transformation — and the potential disruptions that may follow.

By Edgar Varela, MBA ’18

When the first public self-driving car fatality occurred in May 2016, the emerging autonomous vehicle industry found itself at the center of a firestorm. On the surface, things looked bad: A Tesla Model S in autopilot mode plowed directly into a turning semi-truck on a city street in Williston, Florida, killing Tesla driver Joshua Brown.

The National Highway Transportation Safety Administration dispatched an investigative team to find out what had gone wrong. Meanwhile, everyone else waited and wondered: Was this the public relations disaster that would put the brakes on the political, legal, and societal acceptance of self-driving vehicles?

Fast forward to January 2017. The NHTSA exonerates Tesla from fault in the crash. The autonomous vehicle industry is ecstatic. The car’s low-level autonomous autopilot mode is considered an enhanced safety feature, not a substitute for human control. The vehicle was never billed as having the capacity to drive itself. The driver should have kept his hands on the wheel and his eyes on the road at all times.

Autonomous vehicle safety

Instead of stopping the autonomous vehicle industry in its tracks, the Florida crash set in motion a fact-finding mission that led to a resounding endorsement of Tesla’s safety record. The report showed a 40 percent reduction in Tesla accidents since the introduction of low-level autonomy safety features like lane-change assist and automatic braking.

Tesla could now lay claim to having the safest fleet on the roadway. A report that could have been disastrous ended up serving as an official seal of approval. Very quietly, the autonomous vehicle revolution began shifting into high gear.

My belief in the imminence of this revolution led me to pursue my McCombs CleanTech fellowship at UT’s Center for Transportation Research. My work there has focused on what transportation will look like in the coming decades. I have learned that we are standing on the brink of a massive societal transformation that will go far beyond the auto industry.

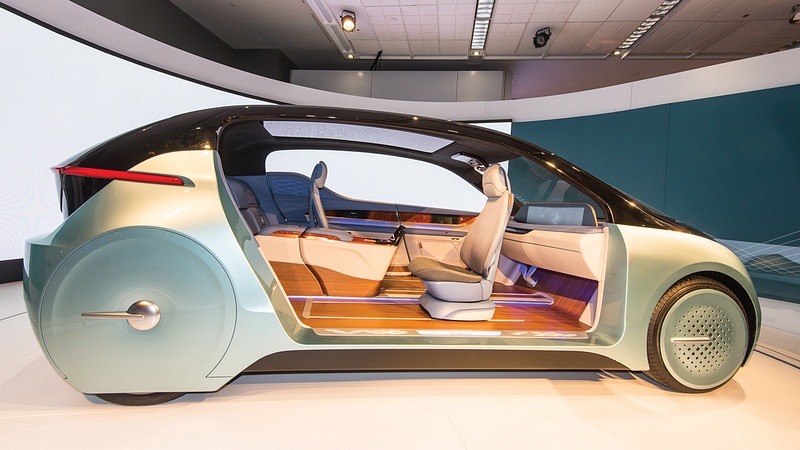

Pathway to full autonomy

The NHTSA defines six levels of autonomy that range from zero (no autonomous features) to five (fully automated with no driver necessary). The Tesla involved in the Florida fatality had level-two autonomy capability with lane-change assist and automatic braking. Glare from the sun interfered with the car’s ability to “see” the truck that turned into its path. The vehicle failed to automatically brake. But this car was not fully autonomous and should not have been used as such by its driver.

While vehicles with level-four autonomy will not be available for sale to the general public for a number of years, production of vehicles with lower levels of autonomy is increasing rapidly. For instance, Toyota, seeking to lead the way in safety, has made its suite of low-level autonomous technologies standard on all 2017 models.

This is well in advance of an agreement between the NHTSA and the majority of U.S. automakers to have automatic emergency braking on all new vehicles by 2022. And beginning next year, the NHTSA intends to make the availability of low-level autonomous safety systems a consideration in its 5-star safety rating qualifications. What looks to be a rapid course toward improved highway safety is greatly welcome, given that there were more than 40,000 deaths on U.S. roadways last year. But this good news may have unintended negative consequences for certain business sectors.

Auto insurance disruption

At first glance, the idea that vehicles with even low levels of autonomy can significantly reduce roadway accidents seems like a win-win proposition, but according to James Kuhr, research associate with the Network Modeling Center at the Center for Transportation Research, the kind of large-scale accident reduction that is on the horizon could put a major dent in the $220 billion auto insurance industry.

“I gave a presentation at an insurance conference last month,” says Kuhr, “and, oh boy, did the crowd look unhappy after I was done.”

Kuhr says that in 10 years, it is likely that enough vehicles with low-level autonomy will have saturated the roadways that we can anticipate 40 percent fewer automobile accidents across the board.

So doesn’t that mean that insurance companies end up better off? Won’t they have fewer expenses due to payouts? Yes, but a reduction in payouts leads to lower premiums. Of course, there will always be some risk for accidents, so premiums won’t completely disappear, and neither will the insurance industry.

But if there are suddenly far fewer accidents, the 315,000 U.S. insurance claims adjusters, appraisers, examiners, and investigators will experience a significant reduction in job security. Fewer accidents equates to fewer client interactions, less case work, and, ultimately, fewer adjusters. The story could be the same for the nearly 385,700 auto insurance sales agents nationwide.

Beyond the insurance industry, there are 40,000 U.S. collision body shops and numerous emergency response personnel who might find themselves with a greatly reduced clientele.

Moreover, insurance companies are major U.S. bondholders — what happens if they suddenly decide they need to liquidate these assets?

And the kicker to all this: The 40 percent reduction described above is most likely a minimum. With continued improvement of autonomous vehicle technology a near certainty, we should expect to see meaningful reductions in roadway accidents and deaths well beyond what we are already beginning to see now.

Prediction uncertainty

Granted, these “what if ” scenarios could play out in an infinite number of ways. But as we continue to see brick-and-mortar retail businesses shuttering in the face of online competition, it is safe to say that industry-wide upheaval due to new technology is not uncommon. In the process, some business sectors will falter while others come to life.

Yet it’s highly speculative predicting how this major shift in the transportation ecosystem will play out in the future.

“It’s very easy to take an existing transportation model and start adjusting numbers arbitrarily to try to predict effects,” explains Center for Transportation Research Director Chandra Bhat. “However, determining what actual adjustments will occur is very difficult. It requires going deep into the foundations of human behavior and how we adapt to the technological revolution in terms of our residential and work locations, vehicle ownership and use, and activity-travel pattern choices.”

For instance, center researchers have produced several adoption prediction models that indicate decades of mixed traffic made up of semi-autonomous, fully autonomous, and traditional vehicle types. However, if the market experiences an influx of other disruptive technologies in addition to those we are already seeing — everything from electric vehicles to flying drones — current projections could play out in innumerably different ways. Ridesourcing, for example, could disrupt a system that is already being upended by autonomy.

Ridesourcing, autonomy, and liability

Ridesourcing has experienced a meteoric rise since Uber began service just eight years ago. Since then, its private market valuation has eclipsed that of the largest auto manufacturer in the U.S., General Motors Co. And the traditional auto industry powers have taken note by making huge investments in ridesourcing entities — GM, for instance, owns 10 percent of Lyft. Official statements from GM, Ford Motor Co., and others indicate that the first completely autonomous vehicles on the road are likely to be introduced in ridesourcing enterprises by 2021.

From both a legal and business perspective, this makes sense: Auto manufacturers earn the majority of their profit from SUVs and trucks, while their small car divisions account for a minor, volatile piece of their portfolios. If they move from selling small cars to selling rides, this could introduce a more consistent market demand.

Additionally, if auto manufacturers begin working with transit agencies, they could move even further toward replacing an erratic line with steady, assured revenue.

Liability considerations attached to autonomous vehicles support this model: From a legal perspective, if an autonomous system malfunctions, the liability is likely to stay with the auto manufacturer. Maintaining control of self-driving fleets would allow for steady maintenance and updates — providing greater control of this risk. The liability risk alone could be significant enough to assure that fully autonomous vehicles remain almost exclusively within ridesourcing enterprises for a long time.

Chevrolet is already out of the gate with this idea. Its new level-four autonomous Chevy Bolt is now in production and expected to be released in a ride-sourcing capacity as early as next year.

Consumers are leary

Even as the auto industry makes its plans, there is another aspect to the autonomous vehicle issue: How interested is the broader American public? Will individuals and households want to own their own self-driving cars? Or will they move en masse to ride- sourcing autonomous transport? And how will the driving public react to sharing the road with this new breed of vehicle?

According to industry surveys, nearly 50 percent of respondents across the socioeconomic spec- trum have no (or only slight) interest in autonomous vehicle ridesharing or ownership. More than 60 percent said they were very worried about equipment failure — they simply do not trust the technology.

Air travel parallels

One explanation for this reticence could simply be fear of the unknown. A similar apprehension about a dangerous-sounding new transportation technology took place in the 1910s and ’20s when commercial airlines were literally taking off. Imagine how scary it was to consider climbing aboard a massive, winged, cylindrical steel object that transported you by flying through the sky? Yet, as more people experienced safe flights, trust in air transportation grew.

It took commercial aviation many years to achieve today’s safety standards. As safety improved, so did the number of travelers: Airline ridership grew from 6,000 passengers in 1926 to approximately 173,000 in 1929. A decade later, it had risen to nearly one million. More than 60 years elapsed between the first scheduled U.S. commercial airline flight in 1914 and the industry’s achievement of a sustained safety plateau in the 1970s.

In 2016, more than 3.7 billion passengers flew safely on more than 40.4 million commercial flights, according to the International Air Transport Association. Unfortunately 10 fatal air accidents caused 268 deaths, but compare that with 40,000 deaths on U.S. roadways last year. That equates to approximately 86 airliners falling from the sky per year. Unlike flying, driving is still one of our most dangerous activities, and most of us do it every day.

Compare that with self-driving cars. In more than 3 million logged miles on public roads since Google pioneered self-driving technology in 2009, it has experienced only one minor accident where the autonomous vehicle was at fault.

A far safer future

I personally take great comfort in knowing that 10 years from now, there will be far fewer deaths on roadways thanks to autonomous vehicles. And I believe that the majority of people will start to feel the same way once the technology becomes an integral part of everyone’s lives.

Yet, as we stand at the dawn of this new transportation age, business professionals in every industry must be forward-looking. We must adapt our business strategies and interests with eyes wide open about potential upheavals. We must be vigilant in tracking how changes up and down the supply chain might play out. Otherwise, someone will likely come along and optimize our industry right out from under us.

And beyond self-interest, in striving to be good citizens of the world, we need to consider the wider societal effects of autonomous vehicles. For instance, how do we address potential layoffs in the insurance and truck driving industries? Is it possible to retrain drivers for other high-demand professions? How do we handle a potential 20 percent reduction in organ donations due to fewer fatalities on the roadway?

Right now, we don’t have the answers to these questions, but it’s not too early to begin thinking about the solutions.

From the Fall 2017 issue of McCombs, the magazine for alumni and friends of the McCombs School of Business. Full PDF